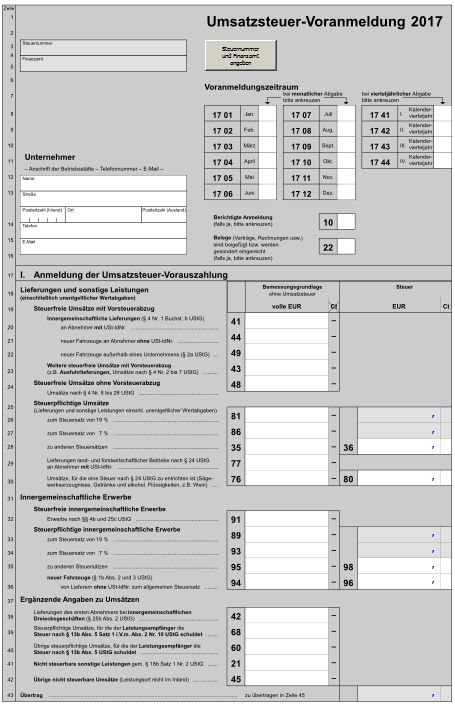

? As a Kleinunternehmer, you will have less accounting work. And if you have many customers who are private individuals, rather than businesses, then being a Kleinunternehmer will give you a competitive advantage. This is because individuals cannot reclaim VAT, so anything they can buy that doesn’t incur VAT is automatically cheaper for them. ? However, being a Kleinunternehmer will be a disadvantage if your business is about to incur a large business expense. When should I submit an Umsatzsteuervoranmeldung ? In this case, you won’t be able to deduct the VAT on the purchase because you won’t be making VAT returns. When you have to submit the Umsatzsteuervoranmeldung will depend on the turnover of your business. Your Finanzamt will let you know whether you need to make monthly or quarterly VAT returns. In both cases, the return must be submitted digitally, ie. via the Finanzamt’s ELSTER tax portal, by the 10th of the following month. For example, if you have to file a monthly return, the return for June will be due on 10 July. However, if the filing date is a public holiday or falls on a weekend, the deadline is automatically extended to the next working day. ? Accountable Tip : If this deadline is too short for you, you can apply for a permanent deadline extension. This extends the deadline by an additional month.

How do I make my Umsatzsteuervoranmeldung ? In our example, you would not have to submit the Umsatzsteuervoranmeldung for June until 10 August. The Umsatzsteuervoranmeldung is much less complicated than the annual VAT return. Apart from the usual information, such as your tax number and contact details, you only need to fill in the income you earned in the given period. While you’re there, you can also reclaim any VAT you have paid as part of your business expenses. Once you have entered your income and expenses, the amounts are directly offset against each other at the end of the VAT return.

0 kommentar(er)

0 kommentar(er)